45+ why do mortgage lenders need bank statements

Find A Lender That Offers Great Service. Comparisons Trusted by 55000000.

Why Does A Mortgage Lender Need Bank Statements Quora

One of the things a lender looks for before approving a loan is your overall financial situation and reserves.

. Web A bank statement mortgage uses bank deposits instead of tax returns to verify your income on a mortgage application Bank statement loans are nontraditional. Ad Check Todays Mortgage Rates at Top-Rated Lenders. Looking For Conventional Home Loan.

Web Mortgage lenders need you to provide them with bank statements so that they can verify your income and affordability check for any risk factors and see. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Banks and mortgage lenders underwrite loans based on a variety of criteria including income assets savings.

To reduce the risk of the use of acquired funds by the borrower for illegal activities such as terrorist funding or. Ad 5 Best Home Loan Lenders Compared Reviewed. In a letter to the board released over.

They tend to offer much better interest rates and terms compared to. Web Why do mortgage companies need bank statements. Ad 5 Best Home Loan Lenders Compared Reviewed.

Compare Lenders And Find Out Which One Suits You Best. The general rule with mortgages is that lenders will want to see that your propertys monthly mortgage. Web Why Do Lenders Need Bank Statements.

Web Generally mortgage lenders require the last 60 days of bank statements. Apply And See Todays Great Rates From These Online Lenders. Web Bank statements provide mortgage lenders accurate income history and verify your ability to repay a loan.

Web Proof Check Cleared. Web Understanding How Lenders Verify Bank Statements Banks and mortgage lenders underwrite loans based on a variety of criteria including income assets savings. Web The reason a lender will need to see your bank statements is to learn more about you as a person and what your spending habits are like.

Web Why Do Mortgage Lenders Need Bank Statements. Web Why Do Lenders Request Bank Statements. Best Mortgage Lenders Best Mortgage Refi Lenders Best Lenders for.

Web Why do mortgage lenders need bank statements. For example on a purchase. A bank statement mortgage can be helpful if youre self-employed and large tax deductions make your income look.

Compare Apply Directly Online. Lenders request bank statements to determine your eligibility for a loan or to satisfy the requirements of. Theyre looking to see.

Mortgage lenders need bank statements to ensure. Best Savings Accounts. Web The 40 Rule and the 45 Rule in House Buying.

Compare Apply Directly Online. Use Our Comparison Find Out Which Mortgage Company Suites You The Best. Web Is a bank statement mortgage right for you.

When you apply for a mortgage your lender uses bank statements to verify that you have enough money to. Web 3 hours agoBank Loans. Conventional loans are available through virtually every mortgage lender.

Compare Lenders And Find Out Which One Suits You Best. Web Mortgage lenders require bank statements from their borrowers during the application process to verify income assets and their overall eligibility for a loan. Best Debt Consolidation Loans Homebuying.

Web Conventional loans. Looking For Conventional Home Loan. Compare Best Mortgage Lenders And Apply Easily.

Bank statements can be used by a lender to verify that a check or other funds have cleared your account. Ad Compare More Than Just Rates. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

To learn more about the documentation required to apply for a home loan contact a loan. Because lenders want to know your past financial behaviour so they can be confident that you will be able to pay your. Web Bank statement loans are a type of mortgage that lenders can issue based on personal information and bank statements rather than tax returns and employer.

How you have acted lately. Web Why do mortgage lenders need bank statements. Comparisons Trusted by 55000000.

Web Why Mortgage Lenders Need Bank Statements When you apply for a home loan the mortgage lender will want to know everything about your current financial situation. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web 9 hours agoSoroban Capital Partners a hedge fund that owns about 16 billion worth of Union Pacific shares believes a shake-up in order.

Ad Best Mortgage Companies of 2022.

Personal Loan Application Form Template Inspirational Loan Application Form By Mj Loan Application Application Form Job Application Form

Why Many Borrowers Turn To Nonprofit Mortgage Lenders The Business Journals

3 032 Mortgage Statement Stock Photos Free Royalty Free Stock Photos From Dreamstime

Ukrainian Law Firms 2021 A Handbook For Foreign Clients By Olga Usenko Issuu

How Many Bank Statements Do You Need To Apply For A Mortgage Cotswold Homes

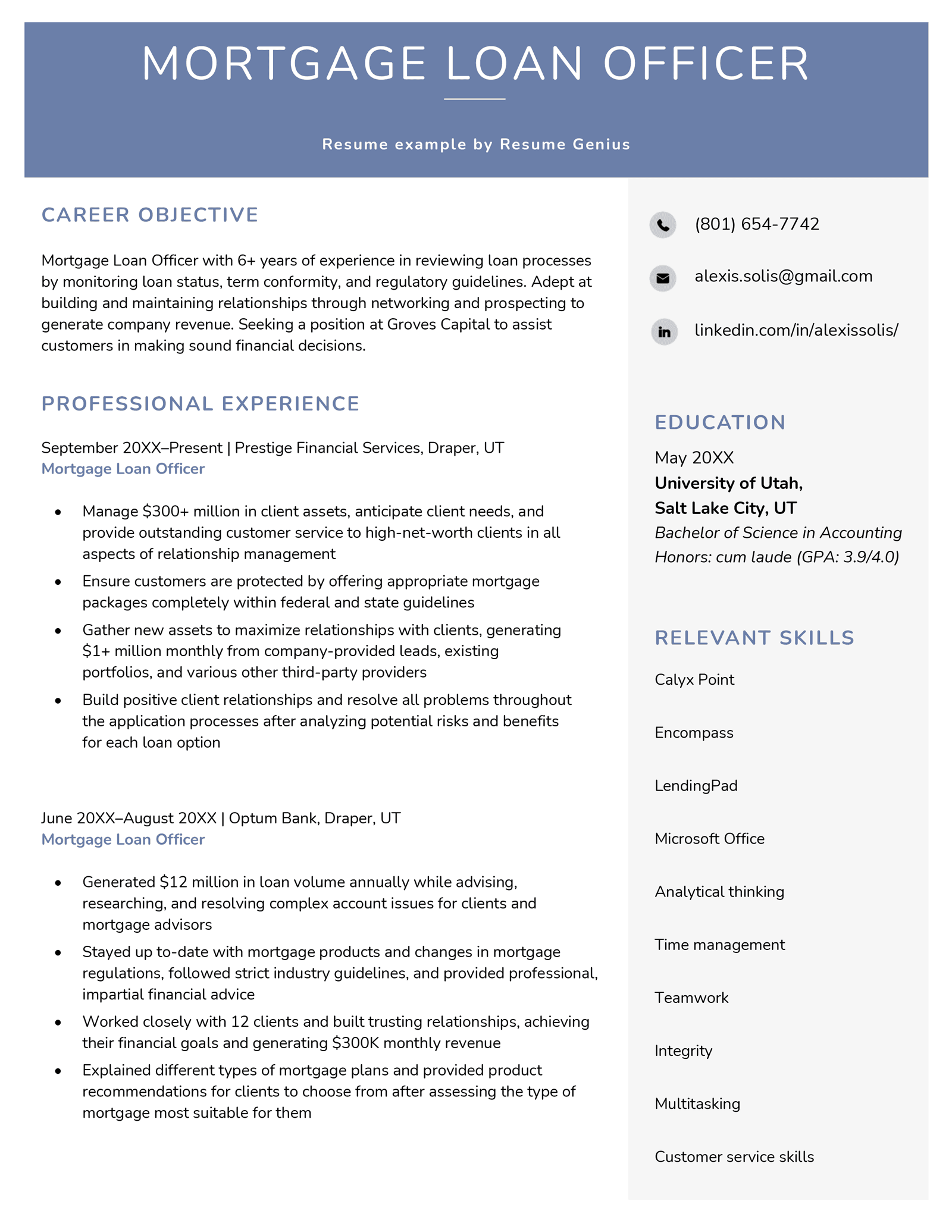

Mortgage Loan Officer Resume Example Template

Is It Possible To Transfer A Commercial Loan To Another Bank Quora

Mortgage Software Prices Reviews Capterra Canada 2023

Financial Report 2017 By African Development Bank Issuu

The Exciting Download Personal Loan Agreement Template Pdf Rtf Word Regarding Blank Loan Agreement Te Contract Template Personal Loans Statement Template

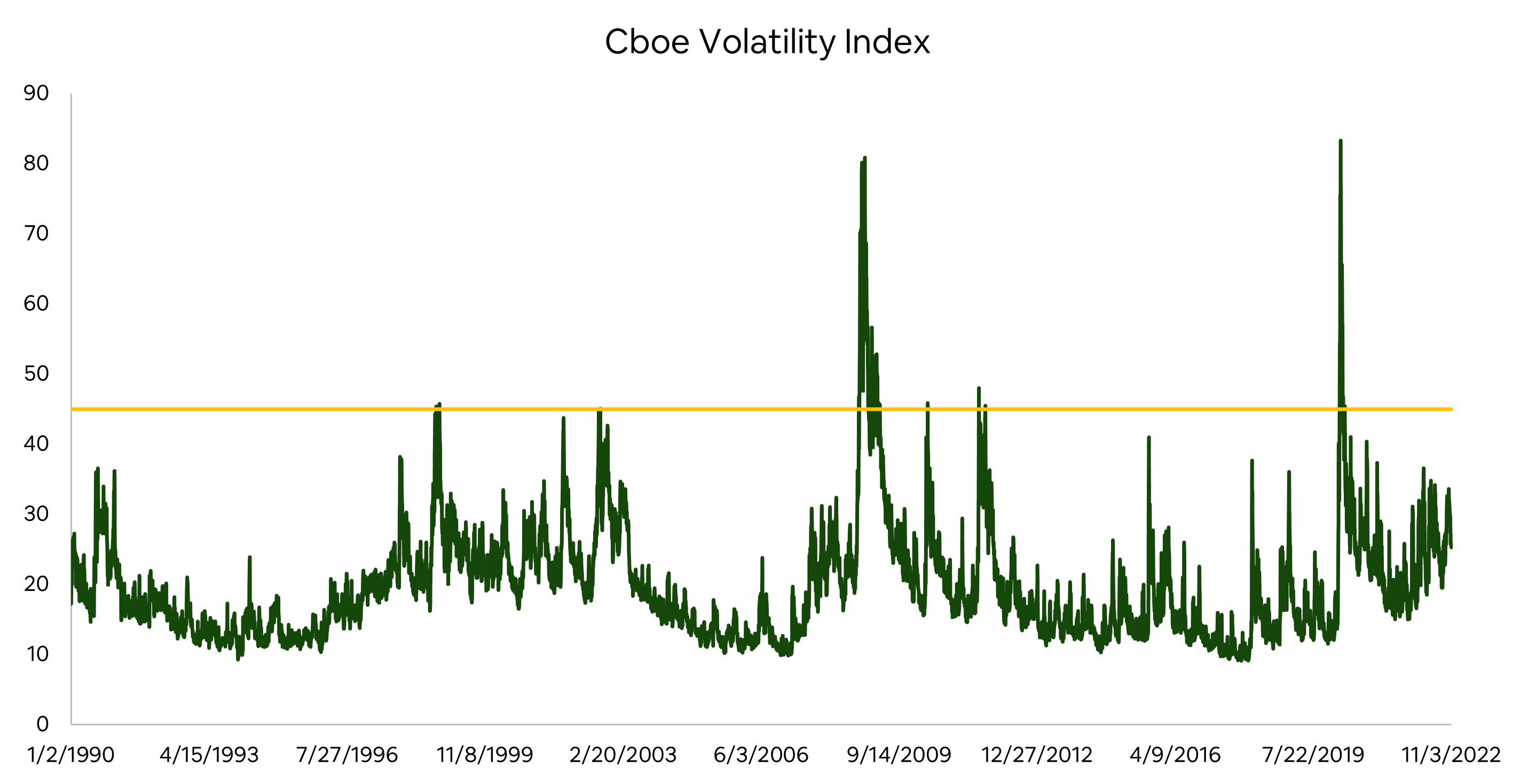

Vix Signaling No Recession By Paul Cerro

What Is A Bank Statement Mortgage

Construction Loan Administrator Resume Samples Qwikresume

What Is A Mortgage Statement Zolo Ca

How To Apply For The German Freelance Visa All About Berlin

Bank Statements Needed For A Home Loan Rocket Mortgage

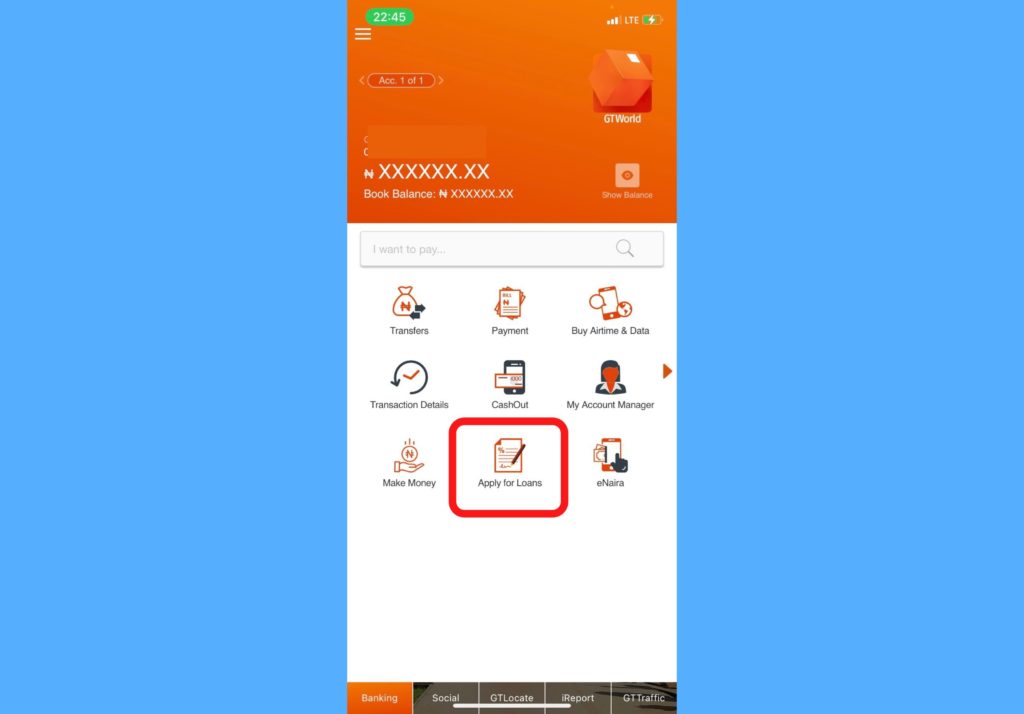

Gtbank Quick Credit Loan Eligibility How To Apply Ussd Code Dignited